While China is planning to cut 500 million tons of clinker each year to restructure the industry and balance supply and demand, in Vietnam, policies are encouraging an increase in capacity and output, opening up a new stage of recovery and breakthrough for the cement industry.

1. Domestic market: Prolonged rainy season slows down consumption

Output and general trends

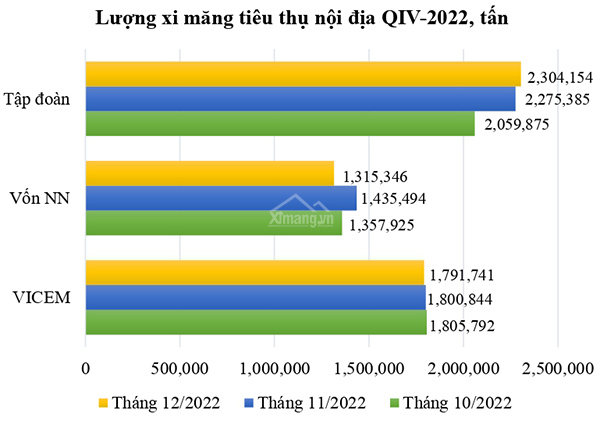

In Q3/2025, domestic cement consumption reached about 18 million tons, equivalent to 79% of Q2, a decrease of about 21%. The main reason comes from unfavorable weather: prolonged storms disrupted construction and clinker transportation, especially in the northern and central provinces – which were directly affected by four major storms in September 2025 alone.

Not only did consumption decline, but many enterprises also faced marine transportation risks. A typical case was the Thái Hà 8888 vessel carrying over 6,000 tons of bulk cement, which sank off the coast of Thừa Thiên Huế in October, causing significant cargo damage.

Southern region: Resilient and booming

In contrast to the North, the Southern market maintained stable consumption thanks to strong momentum from public investment. The disbursement of capital reached the highest level in many years, boosting stable demand for basic materials such as cement, steel, sand, and stone.

Key infrastructure projects such as the North–South Expressway (phase 2), Ring Road 3 in Ho Chi Minh City, Ring Road 4 in Hanoi, Long Thanh Airport, along with a series of port, bridge, and road projects, are entering peak construction phases, helping cement factories in the southern region maintain steady production.

2. Export market: A bright spot during the low season

Contrary to the domestic slowdown, Vietnam’s cement export market in Q3/2025 continued to improve. The total volume of cement and clinker exports reached about 9.5 million tons, up roughly 10% compared to Q2/2025.

Domestic enterprises actively expanded export orders to the Middle East, Africa, and Eastern Europe to maintain stable operations amid domestic challenges. Despite trade barriers such as anti-dumping duties in the Philippines and Taiwan, or a 20% import tariff in the U.S., Vietnamese cement has maintained its export momentum, affirming its competitiveness in the mid-to-high segment of the regional market.

Moving towards “green” production

In addition to trade activities, Vietnam’s cement industry is accelerating its green transformation. While major competitors such as China and Indonesia have carried out strong restructuring and applied mandatory renewable energy ratios, Vietnam has also made significant progress. Companies such as Vicem, Lam Thach, and Cong Thanh are investing in waste-heat recovery power generation systems to reduce CO₂ emissions and optimize energy costs in production.

3. Q4/2025 Outlook: Expectation of strong recovery

Entering Q4/2025, with drier weather and continued strong disbursement of public investment, the cement market is expected to see strong growth in both domestic and export demand.

If there are no major fluctuations in energy or transport costs, Q4/2025 is forecast to be a “breakthrough” quarter, helping enterprises offset Q3’s decline and opening a new growth cycle for the entire industry.

VietnamCement #CementMarket2025 #ClinkerExport #VietnamExporter #CementIndustry #SustainableCement #GreenBuildingMaterials #CementTrade #ConstructionVietnam #Greencement

Source: ximang.vn

Author: Elly Nguyen (+84 369 980 010)